The Central Bank of Nigeria (CBN) has taken significant steps to improve Nigerians’ access to cash through Over-The-Counter (OTC) withdrawals and Automated Teller Machines (ATMs) in Deposit Money Banks (DMBs). In line with this effort, the apex bank has published a comprehensive directory featuring contact details and email addresses of its branches nationwide. This initiative aims to enable the public to report cash availability issues effectively.

CBN’s New Directive on Cash Accessibility

In a circular dated November 29, 2024, the CBN outlined its renewed commitment to ensuring efficient currency circulation across the economy. Titled ‘Cash Availability Over the Counter in Deposit Money Banks (DMBs) and Automated Teller Machines (ATMs),’ the directive emphasizes the importance of resolving challenges related to cash shortages.

You May Also Like..This

Effective December 1, 2024, the circular was jointly signed by the acting Director of Currency Operations, Solaja Olayemi, and the acting Director of Branch Operations, Isa-Olatinwo Aisha. This collaboration underscores the CBN’s determination to streamline the flow of currency and address concerns from citizens and businesses alike.

Public Engagement for Reporting Cash Issues

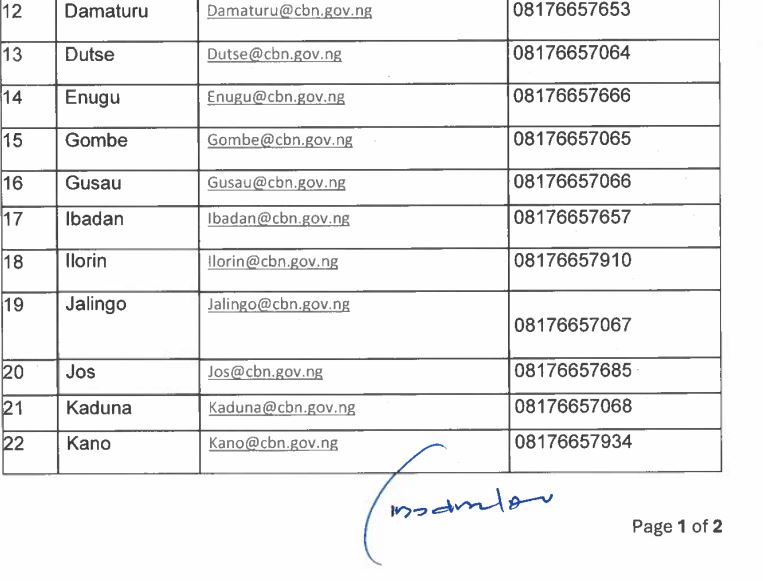

To foster transparency and public participation, the CBN has provided a structured avenue for Nigerians to report challenges encountered at banks or ATMs. The contact directory released includes branch-specific phone numbers and email addresses, ensuring that customers can quickly communicate their grievances. This move not only empowers the public but also holds financial institutions accountable for maintaining seamless cash services.

The CBN reiterated its dedication to resolving any disruptions that might hinder Nigerians’ access to cash, highlighting that currency circulation plays a critical role in sustaining economic stability.

A Response to Cash Circulation Challenges

Over the past year, cash availability in Nigeria has faced significant hurdles, including logistical issues, increased demand, and occasional ATM downtimes. The CBN’s latest initiative seeks to address these challenges by enhancing oversight and fostering accountability within the banking sector. The directory also serves as a tool for monitoring the efficiency of cash distribution systems nationwide.

Key Objectives of the CBN Circular

- Improved Cash Circulation: The directive aims to ensure a balanced and steady flow of currency, reducing bottlenecks that have previously disrupted the system.

- Enhanced Public Engagement: By providing direct contact details, the CBN encourages citizens to actively report concerns, helping to identify and resolve issues in real-time.

- Strengthened Financial Accountability: The initiative underscores the importance of holding banks accountable for delivering cash services promptly and efficiently.

What This Means for Nigerians

For everyday Nigerians, this development promises improved access to physical cash, which remains crucial for daily transactions in a predominantly cash-reliant economy. Businesses can also benefit from smoother operations as the improved cash flow alleviates delays caused by currency shortages.

Moreover, this effort reflects the CBN’s broader agenda to modernize and stabilize Nigeria’s financial ecosystem. By addressing inefficiencies in cash distribution, the apex bank reinforces its role as a pivotal regulator ensuring economic resilience.

CBN phone number and email address to report banks

Steps to Report Cash Accessibility Issues

If you encounter difficulties accessing cash at your local bank branch or ATM, the CBN advises taking the following steps:

- Identify the Nearest CBN Branch: Use the newly released directory to locate your closest branch.

- Contact the Provided Channels: Reach out through the specified phone numbers or email addresses to report your issue.

- Provide Specific Details: Include relevant information such as the bank’s name, location, and the nature of the issue for quicker resolution.

- Follow Up on Complaints: Stay engaged with the CBN to ensure that your concern is addressed promptly.

The Broader Impact of the Initiative

The release of this directory marks a significant stride in fostering transparency and collaboration between the CBN, financial institutions, and the public. By bridging communication gaps, the initiative is poised to enhance trust in Nigeria’s banking sector while mitigating the frustrations associated with cash shortages.

Additionally, the move aligns with the CBN’s broader mandate to promote financial inclusion. By ensuring that cash remains accessible to all, the apex bank continues to support underserved communities that rely heavily on physical currency.

Discussion about this post